Retirement benefits | SSA

Estimate your benefit amount, determine when to apply, and explore other factors that may affect your retirement planning. Learn how to time your application so your first benefit payment arrives when …

Retirement planning tools - USAGov

Apr 1, 2025 · Use USAGov's benefit finder tool to find retirement benefits that may help with living expenses, health care, medications, and more. If you are a federal employee, visit the OPM …

How to plan for retirement | Fidelity

Jun 30, 2025 · Take one step at a time on this lifelong journey. If you're saving for retirement, the best way to help ensure success is by saving consistently (Fidelity suggests saving 15% of your income …

AARP® Official Site - Join & Explore the Benefits

AARP is the nation's largest nonprofit, nonpartisan organization dedicated to empowering Americans 50 and older to choose how they live as they age.

Retirement Planning: Guide to a Secure Financial Future

Dec 2, 2025 · Retirement starts at about age 64, on average, for American workers and lasts roughly 20 years. Average retirement age varies by state and ranges from age 61 to 67, according to a Madison …

Retirement Explained: How to Prepare | GOBankingRates

Jul 30, 2025 · Quick Answer: Retirement is the stage of life where you stop full-time work and begin to rely on savings, investments, and benefits like Social Security to cover your expenses. For many, …

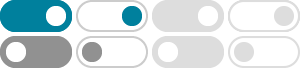

Retirement | The Standard

Planning for retirement doesn't have to be complicated. Start by enrolling today, so you can get all of the benefits of joining your employer's plan — and see just how easy it can be to save for the future.

Retirement Resources | Bankrate

Get the latest information on individual retirement accounts, 401 (k) plans and other retirement strategies. If you’ve reached age 73, you must start taking RMDs. Use this table as a guide....

Retirement 2026 by the Numbers - The New York Times

6 days ago · As the new year begins, savings have hit unprecedented levels, but rising health care costs and growing poverty make retirement unaffordable for many.

Plan for Retirement | SSA

Estimate your benefit amount, determine when to apply, and explore other factors that may affect your retirement planning.